If you're working at a "big CPG" company today, you're likely losing market share to smaller upstarts online. Conditions that used to favor bigger brands have changed and the smartest small sellers have figured out how to make this work for them. Here are some BIG lessons from those upstart sellers that you can use today.

Make Riches in Niches

eCommerce marketplaces are extremely crowded, especially more so today in our post-COVID reality - there are more than 6 million sellers on Amazon's global marketplace alone and only 0.5% of them make $1 million or more per year. To win, you either have to fight it out with hundreds or even thousands of competitors (expensive) OR you can tap into pockets of demand, "niches," that your competition hasn't yet discovered (smart).

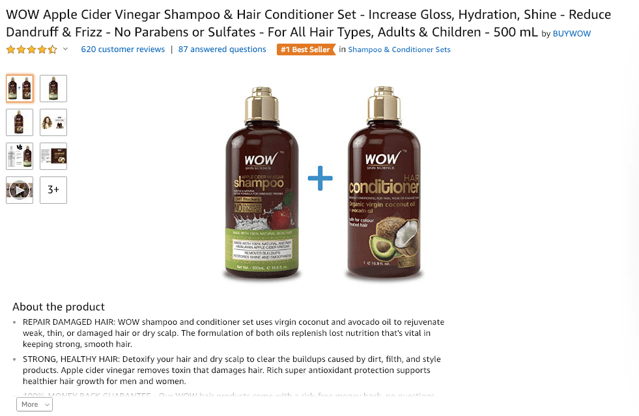

The best small eCommerce players are great at spotting trends and even better at moving fast to capitalize on them. This doesn't take a crystal ball - when combined with category understanding, good analysis can yield great results. The key is spotting demand that isn't being served and in eCommerce, this means high volume / low competition search terms. We found an excellent example in Shampoo with a product called "WOW Apple Cider Vinegar Shampoo."

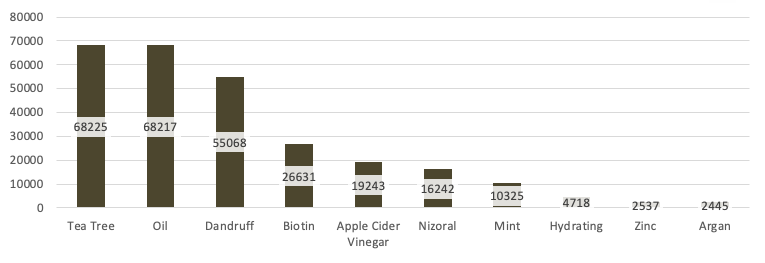

How did they do it? They spotted a trend that almost no one else saw. Below is some recent search data from Shampoo buyers on Amazon showing the types of terms that most commonly come up - data shows the number of monthly searches for certain phrases. While Tea Tree, Dandruff, Hydrating, and Oil are all expected in this category, Apple Cider Vinegar (ACV) stands apart as a new need...

Although it's a smaller segment, it's also FAR less competitive: a search for Dandruff Shampoo will yield over 7,000 competitive items while there are only a handful of brands selling ACV. WOW brand made sure that they would rise to the top of this small group by laser-focusing their listing copy and title on this ingredient. ACV is at the beginning of their title, in their basic and enhanced content, and prominently featured on-pack.

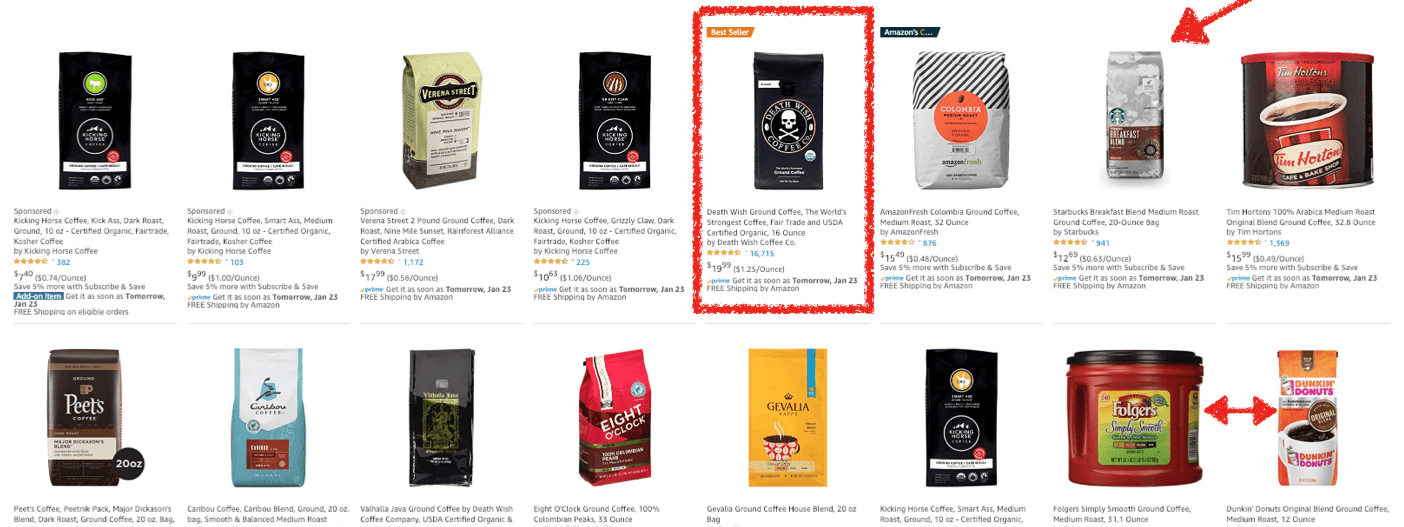

Death Wish coffee is another great example - this Best Selling brand has risen to the top of the Coffee category by appealing to a niche. They are, as they say, "The World's Strongest Coffee." As with WOW ACV, everything they do from title, to images, to pack and marketing emphasizes this positioning. This aggressive focus has allowed them to rise above all of the top grocery brands including Starbucks, Folgers, and Dunkin'.

Focus Distribution Then Expand

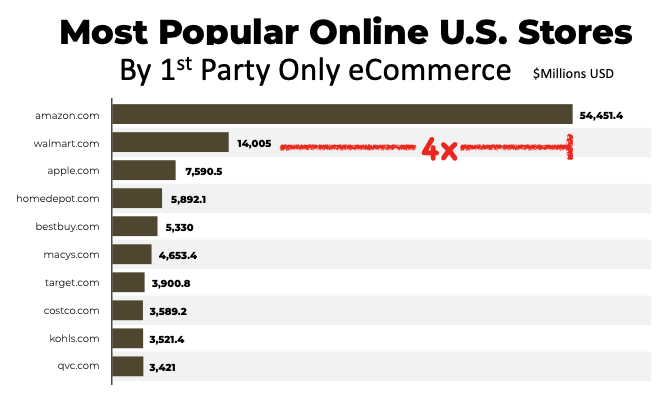

Increasingly, small upstart brands are choosing to focus on 1 - 2 eCommerce distribution channels as they grow instead of trying to manage broader and highly complex retail distribution arrangements. This allows for tighter control of brand and better leverage of scarce marketing and sales resources. With Amazon representing 50% of US eCommerce, this increasingly means winning on Amazon and also with their own Direct-to-Consumer sites.

By the time they've hit 7 - 8 figures of revenue, these brands accumulate mountains of consumer feedback as well as proven growth that they can parlay into broader distribution with the Krogers, Whole Foods, and Walmarts of the world. By that point, they're typically also more "ready" to win at retail and have better negotiating power.

If you're a big brand, we're certainly not suggesting that you give up hard-won distribution for your established items but maybe you should rethink how you bring NEW items to market. Do you really need to achieve full distribution right away or would you be better off fine-tuning your proposition in a more "controllable" part of the market where you can continue to learn post-launch and then expand.

Design to Channel

Once you've decided WHERE to sell, you have to determine WHAT you're going to sell. For years, big companies have robotically grabbed their top physical retail SKUs off the shelf and put them online. In many cases, the items just don't make sense for the channel and they either don't sell OR they sell but fulfillment makes them unprofitable.

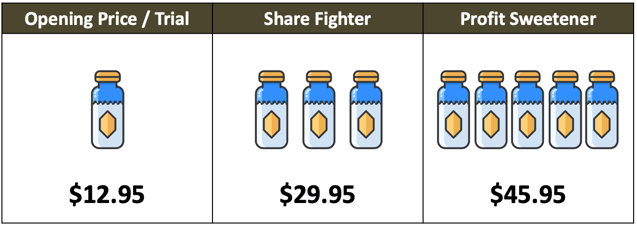

High-performing small players can't afford these big mistakes and, because of this, they've generally been more deliberate and selective in their approach. They've built SKUs to meet the needs of eCommerce by balancing the right consumer price points, efficient shipping economics, and competitive value. This often leads to a strategy featuring 2-3 distinct price bands:

- Opening price / trial driver: With free shipping, it's generally hard to break even on items priced below $15 but these items can still play an important role in driving trial and momentum (which influences ranking).

- Share fighter: In most CPG categories, the bulk of dollars will flow through $20-35 price points so it's important to have competitive items in this range that can fight for market share.

- Profit sweetener: Higher priced items >$35 can be great "profit sweeteners" since shipping as a percentage of sales price is generally lower.

Variety packs also work extremely well, especially on new items where the perceived risk of trial is high. The 3-flavor pack is almost a staple in eCommerce marketplaces appearing in diverse categories from Juices, to Soups, to Cat Food. Very often, these popular mixes end up being the top SKU in a brand portfolio.

Optimize, Test, and Automate

In the large eCommerce marketplaces, conditions change every minute. If your brand doesn't change with those conditions, you will lose. The most savvy small players use a range of testing and optimization tools to keep their brands on top. These include:

- Pricing automation: A broad array of applications are available that can automatically manage your pricing according to different objectives including competitive matching (or "winning the buy box"), target sales velocity, inventory preservation, or profit maximization.

- Marketing optimization: Most brands will use some pay-per-click advertising to achieve and then maintain visibility online. The problem is that the "right" bid for a given keyword can change depending on many factors including your item page conversion rates for each individual keyword and changes in demand. Marketing optimization tools will regularly review your campaigns (ours do it daily) and adjust your bids based either on your criteria or on application-specific algorithms.

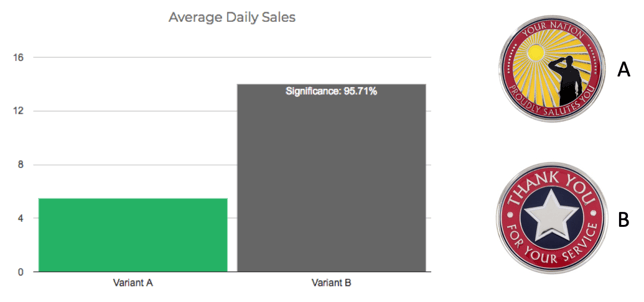

- A/B testing: If you spend some time with eCommerce, you'll discover that small changes can make a big difference. While we all like to think that we can choose the best image or the best copy using our intuition, data is better. A/B testing allows you to use real sales data to optimize your creative or SEO strategy. We conducted a test shown below on a "Thank You For Your Service" coin - by showing side "B" instead of "A" as the Amazon main product image the item more than doubled average daily sales!

Take Control with 3P Selling

3rd party marketplace selling used to be the last resort of brands that couldn't establish 1st party relationships but all of that has changed.Today, Amazon's 3rd party marketplace represents more than half of the company's retail sales. Small brands and small sellers have led the charge and are now growing to be big brands. Puracy is a great example - this personal and home care brand moves the majority of their Amazon volume through the marketplace with Prime shipping enabled by Amazon's pay-to-play fulfillment service (called FBA). The brand's Amazon sales are nearly on par with Febreze!

So why is marketplace selling being taken more seriously today? It all comes down to capability, control, and economics. Over the past few years, reporting and marketing capabilities that used to be reserved for 1st party sellers have become available to 3rd party sellers as well. 3rd party sellers have the additional advantage of more direct control over distribution, content, and pricing levels. Finally, in many cases, the economics of marketplace selling work better for the brand if they can set up the right internal infrastructure (or external help) to make it work.

Work the System

While they can seem overwhelming at first, eCommerce marketplaces yield predictable results when you understand how they work. With the right tools, for example, you can determine quantitatively to a good degree of certainty what activities it will take to achieve Page 1 ranking for a strategic keyword. You can also determine what winning this keyword this will mean for your sales. This will allow you to create solid marketing and promotion plans with predictable outcomes.

The best small sellers know how to get this data and they use it to their advantage every day against their competition. If you want to win, learn which buttons to push and how to push them. If you don't know where to start, get help. We'd be happy to set you on the right course.

If you're a small brand today, your odds of success are greater than ever but you need to know how to execute and win well. If you're a big brand, stop playing defense - learn from your smaller competitors and start taking your share back!

We'd love to help you win - book a free consultation today!