Overview of nutritional powders on Amazon

Sports and nutrition powders have several main players who compete in one or more of the following sub-categories: whey protein, vegan or plant-based, and collagen peptides all with sizeable monthly volume.

|

|

Monthly Revenue |

Avg. Price |

Avg. Rating |

|

Protein Powder |

$12M |

$47 |

4.6 |

|

Collagen Powder |

$8M |

$29 |

4.6 |

|

Plant-Based Protein Powder |

$5M |

$39 |

4.4 |

They are also mature from the standpoint of having well-established brands with high sales and reviews, increased volume in brand-specific searches, multiple price-tiers, and broadened portfolios, including flavors and product alternatives such as protein and collagen peptides.

The highest volume keywords for these products are all primary ingredient relevant rather than brand or benefit-specific.

|

KEYWORD |

MONTHLY SEARCH VOLUME |

|

Protein Powder |

475k |

|

Collagen Powder |

140k |

|

Vegan Protein Powder |

50k |

|

Whey Protein Powder |

50k |

|

Collagen Peptides Powder |

40k |

|

Plant-based Protein Powder |

20k |

Brand Share in the Category

Protein Powder

Regarding protein powder sales, whey makes up the majority, with 80% of the brands in the Top 40 utilizing it. Optimum Nutrition is a significant player in the industry, dominating the protein powder market and generating revenue equivalent to that of the following two top brands combined.

While whey-based powders are the most popular, plant-based options are also becoming increasingly popular. Orgain and Vega are two plant-based brands that made it into the Top 10.

|

Top 10 Brand |

Items |

% Share of Sales |

|

Optimum Nutrition |

4 |

29% |

|

Dymatize |

7 |

19% |

|

Orgain |

3 |

12% |

|

Body Fortress |

1 |

6% |

|

Isopure |

2 |

5% |

|

BSN |

3 |

5% |

|

Vega |

3 |

3% |

|

Levels Nutrition |

1 |

3% |

|

Muscle Milk |

2 |

3% |

|

NAKED nutrition |

1 |

2% |

|

Total Share |

27 |

87% |

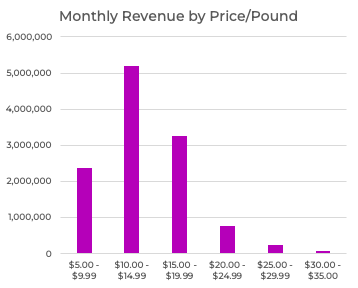

Most brands are priced between $10 and $20 per pound. This price point accounts for about 70% of the market. Within this range, there is a large concentration of top sellers in the $10-15 range, including Optimum Nutrition's top SKU, Orgain and Dymatize. In the $15-20 range, there are additional top sellers from Optimum Nutrition, Dymatize, and Isopure.

Collagen Powder

The market for collagen powder is strong, with many brands represented, and there is a clear focus on beauty benefits and hair, nails, and skin. Many of the top-performing long-tail searches include the phrase "for women."

Vital Proteins is a powerhouse brand in this market, with their "Vital Proteins Collagen Peptides Powder" receiving 16,000 searches, while the next closest brand only has around 2,000 searches. Vital Proteins also generates almost as much revenue as the rest of the top 10 brands combined.

Orgain and Garden of Life are examples of brands crossing multiple nutritional powder categories with offerings in Collagen Peptides and plant-based protein offerings.

|

Top 10 Brand |

Items |

% Sales |

|

Vital Proteins |

6 |

41% |

|

Sports Research |

2 |

12% |

|

Live Conscious |

1 |

8% |

|

Ancient Nutrition |

3 |

5% |

|

Orgain |

2 |

5% |

|

Vital Vitamins |

1 |

4% |

|

Great Lakes Gelatin |

1 |

4% |

|

Physician's CHOICE |

1 |

3% |

|

Bulletproof |

2 |

2% |

|

Garden of Life |

1 |

2% |

|

Total Share |

20 |

85% |

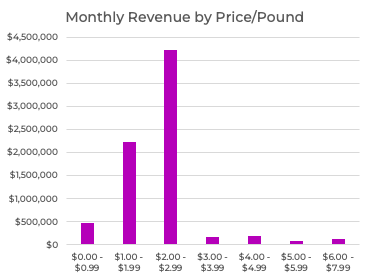

Most sales in the collagen powder category are concentrated in two price-per-ounce ranges.

The premium price range of $2.00-$2.99 per ounce is dominated by Vital Proteins, which garnered an impressive $2.7 million monthly sales. Their Beauty variant is also a popular choice within this range. Another brand that operates in the premium price range is Live Conscious.

The bulk of the other brands in the collagen powder market falls within the $1.00-$1.99 per ounce range. Well-known brands such as Orgain, Sports Research, and Garden of Life all operate within this price range, making up a significant portion of the remaining sales in the market. While Vital Proteins may dominate the more expensive segment of the market, there is still a considerable amount of competition in the more affordable price range.

Vegan and Plant-Based Protein Powder

Although "plant-based protein powder" has a lower search volume than "Vegan protein powder," with 52k searches monthly, it still demonstrates a significant search volume of 20k.

The three leading brands in the "Plant-Based Protein Powder" category account for 78% of the total revenue and 42% of the top 40 ASINS, indicating a sharp decline in sales for other brands beyond the top three.

|

Top 10 Brands |

Items |

% Sales |

|

Orgain |

5 |

35% |

|

Vega |

8 |

23% |

|

Garden of Life |

4 |

20% |

|

KOS |

4 |

5% |

|

NAKED nutrition |

2 |

4% |

|

Truvani |

1 |

3% |

|

Sunwarrior |

2 |

2% |

|

PlantFusion |

1 |

2% |

|

Purely Inspired |

1 |

1% |

|

Optimum Nutrition |

1 |

1% |

|

Total Share |

29 |

95% |

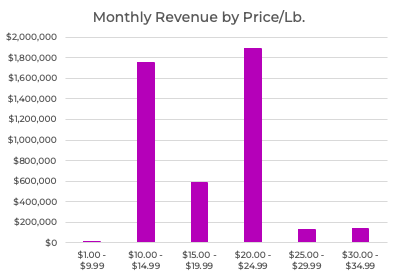

Most sales in the plant-based protein powder category occur within two distinct price-per-pound ranges. The $20 and $25 per pound price point includes most brands, such as Vega's 3.5-4.2 lb SKUs and Garden of Life's 1.8-2.3 lb SKUs.

The $10 and $15 per pound price point shows fewer ASINs, but Orgain's lower price tier strategy dominates it. This suggests that pricing plays a significant role in consumer purchasing decisions and that brands must carefully consider pricing strategies to remain competitive.

Key Takeaways for Nutritional Powders

The sports and nutrition powder market has several established sub-categories with various brands, but the industry has potential for innovation and differentiation.

While the sub-categories are mature, there is still white space to be explored, including: