Clients often ask us if they should be selling on the Walmart marketplace. In our latest Engineered for eCommerce webinar with Firstmovr, we discussed how to determine if Walmart's marketplace is right for your brand and how to best leverage this platform as part of your eCommerce efforts.

We covered:

- How Walmart's eCommerce platform has grown.

- Why you should be taking a look at Walmart's marketplace now.

- How the pandemic accelerated Walmart's marketplace growth.

- Walmart's vision and how they're bringing it to life.

- A closer look at the Walmart Marketplace.

- How to be successful.

- Useful holiday insights to consider.

Below are the key points from our webinar.

A Tale of Two Giants

When Amazon launched its 3rd party marketplace in 1999, Walmart soon followed with Walmart.com in 2000. For the time being, they were really checking the box when it came to having an online presence, and Amazon was lightyears ahead with their innovative services. In fact, Walmart's own third-party marketplace didn't launch until 2009.

Then came Marc Lore. His leadership has helped accelerate Walmart's eCommerce growth! So far this year, partially due to COVID, Walmart's eCommerce growth is up over 70% thanks to Lore. Pre-COVID, he was already driving 30-40% growth. (To learn more about the impact Lore has had, check out our blog, Who is Marc Lore and Why Does He Matter?)

In 2016, Lore led the charge for an acquisition frenzy that included Jet and Hayneedle. We've also seen the introduction of winning assets, including Online Pickup and Delivery (OPD), same and next day delivery, and Scan & Go. And then, of course, there's the elephant in the room: Walmart's enormous physical footprint! We'll get into that next.

Why Walmart

Walmart is the #1 retailer in the world and the #2 eCommerce retailer! Between their massive physical footprint and huge audience, there are a lot of reasons to get your brand on their online marketplace.

Compared to Whole Foods' 500 stores, Walmart has 4,750 brick and mortar locations. They also have more than 150 distribution centers. In other words, they have a wide reach when it comes to physical locations, and considering the fact that 87% of sales still happen in brick and mortar stores, this is an important differentiator.

This also means Walmart has an impressive omni-channel approach with their fast pickup and delivery services as well as easy returns. And Walmart customers are definitely taking advantage of this. 95% of Americans shop at Walmart stores AND online at Walmart.com, which boasts over 120 million unique monthly visitors.

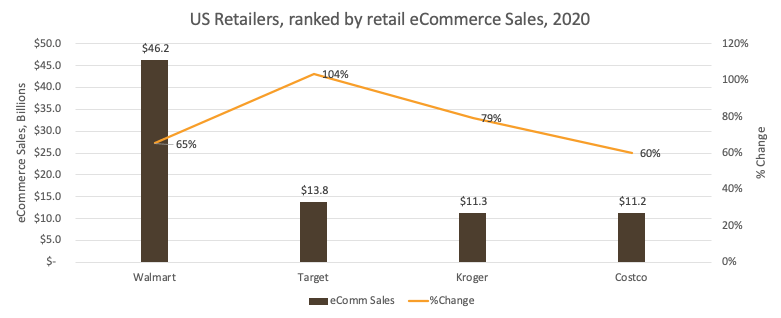

To give you an idea of how big Walmart's eCommerce channel is, here's how other US retailers compare.

Pandemic Pivot

When the pandemic hit, Americans embraced online shopping with fervor. After all, shopping online is far less risky than visiting a physical store. This put a huge strain on Amazon, and led to out-of-stock issues and extreme shipping delays. Amazon Prime closed temporarily, and they stopped accepting new online grocery customers.

Shoppers started looking for new solutions, and Walmart had the perfect answer.

Because of their large geographical footprint and distribution centers peppered across the continental US, Walmart has been able to meet the unique needs of shoppers during the pandemic. With more accessible grocery pickup and delivery, a growing online marketplace, and the rollout of new services, Walmart is experiencing incredible eCommerce growth.

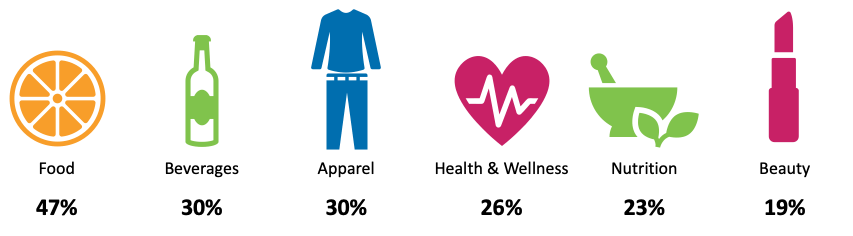

In early April, their marketplace growth was up 300%. There have been 3 times more downloads of the Online Grocery App, 2 times more first time Walmart.com customers, and 2 times more "Pickup today" orders on Walmart.com. They've seen huge increases in demand for what they call "cozy categories", which include work-from-home essentials, family entertainment, health and wellness, and beauty.

In fact, here are the categories Walmart.com and Walmart app shoppers are likely to click on ads for:

Walmart's Vision

Before the pandemic hit, Walmart saw an opportunity in the "busy family" shopper. This shopper has more spending power, and for them, time really does equal money. Here's a quick look at some of the demographics for this group:

- Age 21-50

- Middle to upper income

- 52% have 2+ kids under 18

- 18% Hispanic, 37% multicultural

- Use technology to save time

- On the goal the times

This shopper is constantly on the hunt for the lowest prices, and they want a one-stop-shop with a broad selection. Products need to be in-stock and quick and easy to find. They have a 58% stronger overall impression of Walmart and 28% higher spend than the average Walmart household along with 20% more visits.

Walmart's vision is to "be THE destination for customers to save money, no matter how they want to shop". From their app and brick and mortar stores to services like pick-up and delivery, Walmart is leading the omni-channel experience.

A Vision Come to Life

With the shift in shopper behavior due to the pandemic and a clear vision, Walmart moved forward this year with the launch of Walmart+. Two weeks after launch, they conducted a study through Piplsay to what Americans thought of the new initiative. Below are a few highlights, but you can dig into the full study here.

- 11% of Americans signed up in the first two weeks of launch

- 45% subscribe to both Walmart+ and Amazon Prime

- 19% will drop Amazon Prime for Walmart+

- 35% like unlimited free delivery feature

- 24% favorable to same day delivery

Walmart+ membership benefits include +Unlimited Free Delivery, +Scan & Go, and +Fuel Discounts. To top it off, it's more affordable than Prime at $98 per year compared to Amazon Prime's $119 annual membership.

With the launch of Walmart+ and the huge increase in mobile app adoption, Walmart is also exploring ways to improve their in-store experience. They understand that their most valuable shoppers want in and out quickly. They want help finding items efficiently, and they want to save money.

Recently, they've been rolling out a new shopper experience concept inspired by the Atlanta International Airport. It features bold, clear signage reminiscent of an efficient airport terminal, fully integrated app features that include a store map and item search, and Scan & Go for speedy, contactless checkout.

Walmart Marketplace

Now that we've talked about Walmart's eCommerce focus and their omni-channel vision, let's take a closer look at their marketplace.

Compared to Amazon, Walmart's marketplace is unquestionably smaller with over 50,000 third-party (and counting) sellers compared to Amazon's 1.1 million and more than 36 million products compared to Amazon's 350 million. A smaller pool means more visibility for sellers on Walmart's marketplace. In fact, there are 13 times more visitors per seller.

Of course, when it comes to Walmart vs. Amazon selling, the answer isn't either/or. 57% of Amazon shoppers also shop on Walmart.com. There's no reason not to sell on both platforms.

Plus, Walmart's marketplace comes with benefits. It allows Walmart to offer an expanded variety of products to customers without owning inventory and pricing competition (EDLP). In place of subscription and setup fees, Walmart simply deducts a referral fee from sales. They also offer a variety of services.

The marketplace can also be an excellent place to sell higher margin products and offer an extension of your portfolio, whether that be alternate flavors, variety packs, or bundles. It's prime testing grounds for new innovation, too.

Walmart media has its advantages too. Walmart's model is a first bid auction, which protects small sellers from advertisers gaming the system with extremely high bids. And because there are fewer sellers, cost per click tends to be much lower than on Amazon.

Sellers also have the opportunity to buy sponsored product ad placements, and Walmart is more discerning about these spots. For example, a sponsored product ad only shows up once on the same SERP, and an item must appear organically within the top 128 searches to be eligible.

While Walmart's marketplace isn't perfect and is lagging behind in some capabilities compared to Amazon (like their search algorithm and reporting), they're constantly innovating and improving their platform. Overall, though, the positives outweight the negatives.

How to Be Successful

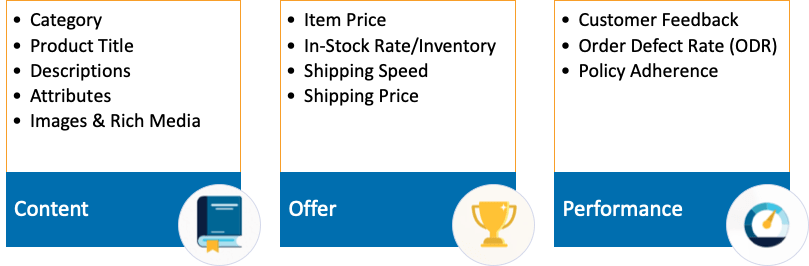

For Walmart, the algorithm truly comes down to listing quality. Their system looks at the content, offer, and performance to gauge quality. This involves having a complete and properly-categorized listing; competitive pricing, a great in-stock rate, and shipping speed; and a combination of customer feedback, a low order defect rate, and policy adherence.

Luckily, Walmart has a tool to measure listing quality, so you won't be left guessing. To learn more about optimizing listings for Walmart.com, check out our blog, 14 Proven Ways to Optimize Listings for Selling on Walmart.com.

To give you an idea of what a big impact meeting Walmart's quality criteria has, we took a look at several case studies.

- When Big Red House offered TwoDay Shipping, color variations, and started accumulating great reviews, they saw a 78% increase in sales.

- Rfiver included descriptive content, appropriate attributes, and good product imagery, resulting in 1,300% order volume increase.

- LuxMod grew their sales by 239% by adding an enhanced title, description, and key features.

Paying attention to your Walmart marketplace listing quality can have a huge impact on your success. Take advantage of the tools offered to you and read Walmart's listing quality guide to learn more.

Lastly, pay close attention to their new initiative: the Walmart Pro Seller Badge. This is still in its pilot stage, having launch just this month. Only 350 sellers currently have this badge, which communicates high quality and reliability to shoppers. Do note that it doesn't necessarily translate into an increased ranking.

To get the Walmart Pro Seller Badge, you must have:

- High on-time delivery rate

- High listing quality

- Free online and in-store returns

- Consistent Marketplace policy compliance

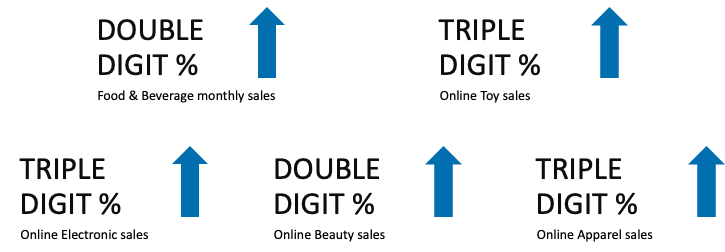

Holiday Insights

With the holiday season coming, we wanted to include some helpful insights about what to expect for key categories on Walmart.com.

Key Takeaways

In conclusion, there are a lot of advantages to being a bigger fish in a smaller pond. You get more of your money's worth on Walmart's marketplace, and their eCommerce channel is growing fast! To learn more about Walmart.com, download our free guide, which covers:

- How to assess the competitive landscape like a pro so that you can identify your best selling opportunities and create a winning strategy.

- How to build and optimize your product listings to win the buy box and rank as high as possible in Walmart’s search algorithm.

- How to grow your Walmart.com business with proven strategies for long term success.